option to tax form

To make a taxable supply out of what otherwise would be an exempt supply. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes.

The Start Of My Korean Adventure Air Asia Passport Photo Asia

The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re.

. This form will report important. Your return is considered filed on time if the. Although it is common to refer to a property when notifying an Option to Tax OTT an OTT actually applies to the land and includes the building standing on the land.

Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. For more information see Form 6251 Alternative Minimum TaxIndividuals and its instructions. Any option to tax does not affect a residential building or residential part of a building.

60 of the gain or loss is taxed at the long-term capital tax rates. From Simple to Advanced Income Taxes. The timing of submission is important.

Opt to tax land andor buildings. Form Revoke an option to tax for VAT purposes within the first 6 months. VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject.

Ad IRS-Approved E-File Provider. Your homes appraised value for the year is based on its condition and what the appraisal district estimates. Value of the stock acquired through the exercise of the option.

The vast majority of businesses dont need or choose to tax their trading premises. Follow the step-by-step instructions below to eSign your vat 1614a. 15 May 2020 Form Certificate to disapply the option to tax buildings.

The main reason a supplier would choose an option to tax is to recover VAT on associated costs. For your protection this form may show only the last four digits of. Certificate to disapply the option to.

The timing of submission is important. Corporations file this form for each transfer of stock to any person pursuant to that persons exercise of an incentive stock option described in section 422b. Over 50 Million Tax Returns Filed.

Employees taxpayer identification number TIN. I tend to remember option to tax forms by their numbers and letters. The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie.

Notification of an option to tax land and or buildings VAT1614A form has been updated. Should I opt to tax. 40 of the gain or loss is taxed at the short-term capital tax rates.

However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and. When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. If youre not able to pay the tax you owe by your original filing due date the balance is subject to interest and a monthly late payment penalty.

Its always in your best interest to. Call HMRC for help on opting to tax land or buildings for VAT purposes. The option to tax allows a business to choose to charge vat on the sale or rental of commercial property ie.

Important local option tax forms. The OTT provisions do not differentiate between commercial or residential land or buildings and therefore whilst it is more common. You complete form VAT 1614A there.

Form for Notification of an option to tax Opting to tax land and buildings on the web. Complete Edit or Print Tax Forms Instantly. If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day.

Revoke an option to tax for vat purposes within the first 6 months use form vat1614c for. Section 1256 options are always taxed as follows. Sign Online button or tick the preview image of the form.

Filing this form gives you until October 15 to file a return. This means changing an exempt supply which you wont be able to recover VAT on into a taxable supply so VAT can be gained. Use this form only to notify your decision to opt to tax land andor buildings.

15 May 2020 Form Certificate to disapply the option to tax buildings. To get started on the form use the Fill camp. Send the completed form and supporting documents to the.

VAT1614C - revoking an option to tax within 6 month cooling off period Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. Quickly Prepare and File Your 2021 Tax Return. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 202 Tax Payment Options. 16 2021 stock swap na cash buy na status expected tax form.

Please complete this form in black ink and use capital letters. This notice has been updated to provide information on who is an authorised signatory for the purposes of notifying an option to tax the details can be found in a new paragraph 76. This rule means the taxation of profits and losses from non-equity options are not affected by how long you hold them.

The advanced tools of the editor will guide you through the editable PDF template. Theres also a penalty for failure to file a tax return so you should file timely even if you cant pay your balance in full. When you exercise an incentive stock option iso there are generally no tax consequences although you will have to use form 6251 to determine if you owe any alternative minimum tax amt.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b. 2 days agoYour home value starts Jan. It also applies to any buildings that are subsequently built on that land.

Ad Access IRS Tax Forms. Information about Form 3921 Exercise of an Incentive Stock Option Under Section 422b including recent updates related forms and instructions on how to file. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension.

For example you need a VAT 1614A in a different situation to a VAT 1614D. Opting to tax is quite easy. Before you complete this form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000.

Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelop In 2021 Tax.

Form 1040 U S Individual Income Tax Return 2015 In 2022 Income Tax Return Tax Return Income Tax

Summary Of Income Tax Provisions For Ay 2021 22 Under Both Old New System Indian Stock Market Hot Tips Picks In Shares Of India In 2021 Income Tax Income Tax

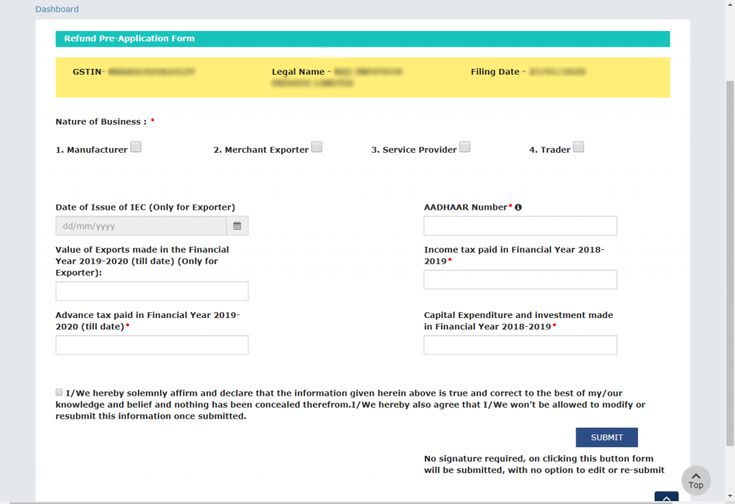

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Blue Summit Supplies Tax Forms W3 Transmittal Tax Forms 10 Count In 2022 Tax Forms Small Business Accounting Software Business Accounting Software

Tax Due Dates Stock Exchange Due Date Income Tax

The Blogger S Simple Guide To Taxes Pdf Ebook Instant Digital Download Tax Forms Schedule C Tax Weightlos Business Planner Small Business Advice Tax Forms

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Business Accounting Software Tax Forms

7 Factors Driving Electric Vehicles Ev S Adoption Electric Cars Electricity Adoption

Form 656 Ppv Offer In Compromise Periodic Payment Voucher Offer In Compromise Tax Debt Debt Problem

Fillable Form 1040 Individual Income Tax Return Income Tax Return Tax Return Income Tax

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Filing Taxes Singapore

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Invest In Nps Investing How To Get Rich How To Plan

Paper Filing Top Documents That Must Be Attached To Your Tax Return Forms Taxreturnforms Tax Return Tax Services Tax

W 11 Form Completed How I Successfully Organized My Very Own W 11 Form Completed Form Example Job Application Template Tax Forms

The Ultimate Guide To The Gdpr S Definition Of Consent Termly Gdpr Consent Termly Resources Consent Forms Online Web Design Business Risk

Deductions Under Chapter Iv A Income Tax Return Life Insurance Premium Tax Deducted At Source

Contract As To Possession Closing Delayed0001 My Realestate Forms